Mto Songwe

JF-Expert Member

- Jul 17, 2023

- 6,024

- 12,320

Source: Bloomberg

Subscribe

By Bloomberg News

December 1, 2023, 7:30 AM GMT+3

Share this article

Gift this article

Less than five years after US sanctions nearly crippled Huawei Technologies Co., the Chinese giant is now Beijing’s most important weapon in a battle over semiconductors that’s poised to shape the world economy for decades to come.

Huawei’s role in China’s chip industry goes far beyond what’s been previously reported. As well as being the most important customer for chip producers and the country’s leading chip designer, Huawei is increasingly lending engineering expertise and financial support to smaller companies in strategic areas of the chip supply chain. It often does this without disclosing its involvement — which would trigger US restrictions.

State support for the company has also reached unprecedented levels. Bloomberg News has uncovered a network of enterprises backed by a Shenzhen city government investment fund, which is focused on helping Huawei build a self-sufficient chip network. This group includes optical specialists, chip equipment developers and chemical manufacturers. This is in addition to the $30 billion state-sponsored endeavor to help Huawei build chip fabrication facilities Bloomberg News first reported on in August.

Source: Bloomberg reporting

“Huawei is now the centerpoint,” said Kendra Schaefer, a partner at Beijing-based consultancy Trivium China. “The export controls have pushed the state and industry together in a way we haven’t seen before.”

Huawei denied that the government is giving it support to develop semiconductor technologies. “This is entirely speculation and conjecture based on information online,” the company said in a statement.

The decision to make Huawei the effective captain of China’s effort to develop a self-sufficient chip industry is the result of a direct order from the top of government, according to people familiar with the matter who asked not to be named due to the sensitivity of the topic.

In Huawei, they have a rare national champion with the grit, scale and technological prowess to push back. Founded in 1987, the company first made its mark in the communications equipment industry before it later expanded into mobile phones. And its combative founder Ren Zhengfei was preparing for disaster years before it struck.

Huawei has long kept a group of black swans on its main campus as a reminder to avoid complacency and prepare for unexpected crises. More than a decade ago, when business was booming, Ren told engineers that continued investment in semiconductor research was the only way to head off a mortal threat to the company. “We can’t just let others to choke us and die just because of that one product,” Ren said.

Ren, founder and chief executive officer of Huawei. Photographer: Qilai Shen/Bloomberg

In the ensuing fight for survival after the US blacklisting in 2019, Ren moved as many as 10,000 developers onto 24-hour shifts in a race to redesign its circuit boards and software so they could function without American technology. At the busiest times, some staff didn’t set foot out of its Shenzhen campus for days, living on instant noodles and sleeping in chairs.

That all-out effort kept the company in business. Around this time, the Chinese state also began to step up its support, paving the way for today’s interdependent relationship.

To see how deeply Huawei and the Chinese government are now entwined, look no further than the launch in August of the new Mate 60 Pro smartphone. Huawei timed the release of the phone to coincide with US Commerce Secretary Gina Raimondo’s visit to China in part because of direct encouragement from a senior official at the top of the regime, according to a person familiar with the situation who asked not to be identified discussing sensitive matters. They’d decided it was time China showed some muscle, the person said.

The $900 smartphone signaled China’s rapid advance. Source: Bloomberg

The request surprised Huawei, which had planned to release the phone at a later date, said a different person. And while the company made the launch date, there was no time for the normal pizazz — or even a proper press event.

Huawei denied that government officials had asked for the Mate 60 Pro phone to be introduced sooner than originally planned.

The significance of the phone was the high proportion of advanced made-in-China components it contained, in particular a 7-nanometer processor from Shanghai’s Semiconductor Manufacturing International Corp. Hailed by state press as a patriotic triumph, it sparked fervent debate within the US about whether its efforts to slow China’s technological advance were falling short.

*Components with multiple suppliersSources: TechInsights and Bloomberg reporting

The concern in Washington is that the advanced semiconductors that power Huawei’s smartphones could also be used for military applications, such as AI-controlled drones or super computers for code-breaking and surveillance. The US is determined to contain China’s defense capabilities as tensions between the two countries rise over issues including the future of Taiwan.

At the center of the network of state enterprises that is assisting Huawei is an investment fund operated by the municipal government of Shenzhen, where Huawei is headquartered. The Shenzhen Major Industry Investment Group Co. was created in 2019 with state capital and given direct orders to support China’s chip efforts and Huawei specifically, according to people familiar with the matter.

It has invested in about a dozen companies in the supply chain, including three Huawei-linked chip fabrication facilities, according to data from Tianyancha, an online platform that provides company registration information. But perhaps its most significant operation is a chipmaking tool company called SiCarrier Technology Ltd., founded in 2021.

SiCarrier has formed a close, symbiotic relationship with Huawei, where it mainly interfaces with the electronic giant’s internal research arm, known as the 2012 Lab. Ren named it after Roland Emmerich’s doomsday film that saw China succeed, when nobody else could, in building vast arks to ride out a planet-wide natural disaster.

Huawei's research and development campus in Dongguan boasts manicured grounds and European style buildings. Photographer: Qilai Shen/Bloomberg

Huawei's Shenzhen headquarters from the above. Photographer: Qilai Shen/Bloomberg

The exchange of talent goes both ways. SiCarrier is vigorously hiring elite engineers to work directly on Huawei’s projects in Shenzhen and Dongguan, according to a person familiar with the matter. (The recruits are told not to reveal who they actually work for.)

Huawei has also transferred about a dozen patents to SiCarrier, including sound-proof technologies for electronic machines and data center designs, according to patent transfer information published by the China National Intellectual Property Administration. Huawei said any suggestion it has an in-depth partnership with SiCarrier to collaborate on chip technologies is “inconsistent with the facts.” Shenzhen Major Industry Investment Group, SiCarrier and its affiliates didn't respond to requests for comment.

SiCarrier operates out of a number of locations around Shenzhen. It has an office in an industry park affiliated with the Chinese Academy of Sciences, and another facility on the top floor of a six-story building inside a small industrial park in Shenzhen’s eastern suburbs. The facility makes components for semiconductor manufacturing equipment, including laser-driven light source gears, pressure control valves, and pumps, according to an evacuation map on the wall. Next to the map are three posters in Chinese with the words Trust, Innovation and Professionalism printed in bold white characters.

Outside SiCarrier’s facility in the eastern suburbs of Shenzhen. Source: Bloomberg

Its importance to Huawei is as far more than just a manufacturer, said people familiar with the relationship: SiCarrier is also a nexus between Huawei and the rest of the supply chain. For example, it’s the largest shareholder in optical machine maker Zetop Technologies Co., according to Tianyancha. Such technology is central to the production of microchips, which are built of layer upon layer of transistors bound to a silicon wafer. The key to this is a process known as lithography where light is projected through a blueprint of the pattern that will be printed.

Zetop’s second biggest shareholder is Changchun Institute of Optics, Fine Mechanics and Physics. An affiliate of the elite Chinese Academy of Sciences, it boasts of developing some of China’s best optical technologies for lithography machines.

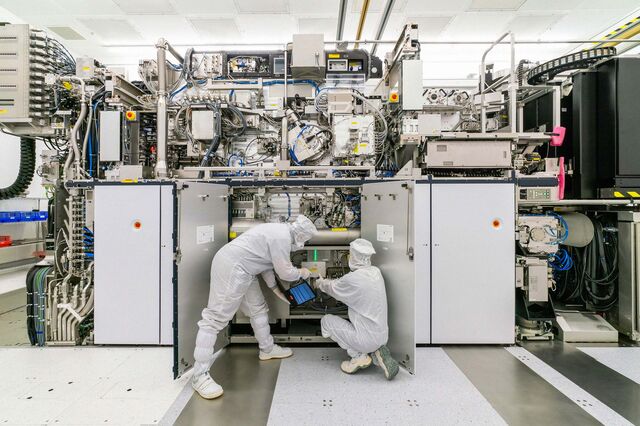

Lithography is a particularly crucial area because Dutch company ASML Holding NV has a monopoly on extreme ultraviolet lithography gear — needed to make the most advanced chips — and has never sold those machines to China. With the imposition of US sanctions, ASML will also stop selling Chinese customers most deep ultraviolet equipment, slightly less sophisticated machines for manufacturing semiconductors.

Employees assemble a lithography machine at the ASML Holding NV factory in Veldhoven, Netherlands. Source: ASML Holding NV

Following its blacklisting, Huawei has hired a number of former ASML employees to help work on chipmaking machines, according to one person familiar with the matter and social media records. Bloomberg News found LinkedIn profiles of five former ASML staff members — including two previously based in the Netherlands — who said they joined Huawei between 2021 and 2022. None responded to requests for comment.

While it will be a long slog to fully catch-up — EUV equipment took the West decades and hundreds of millions of dollars to develop — the release of the Mate 60 smartphone suggests the gigantic effort centered on Huawei is making progress.

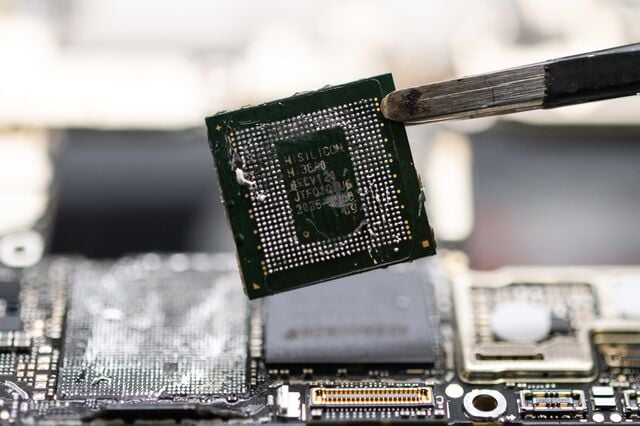

A specialist disassembles a Huawei Mate 60 Pro smartphone and removes the Kirin 9000s chip. Photographer: James Park/Bloomberg

Huawei never disclosed technical details, but a teardown of the handset conducted by TechInsights for Bloomberg News found it was powered by SMIC’s advanced 7-nanometer processor. That suggests China is roughly five years behind the current most advanced technology. Export controls imposed by the Biden administration in 2022 were aimed at keeping China at least eight years behind.

Huawei is getting a commercial boost too. The launch of the Mate 60 Pro reinvigorated its devices business, with analysts expecting the handset's sales to soar to 40 million to 60 million units next year.

“More government subsidies will make it even harder for Huawei to portray itself as independent. But subsidies will also let Huawei sell products at lower prices,” said Chris Miller, author of Chip War: The Fight for the World’s Most Critical Technology. “In many emerging markets, this will probably enable Huawei to win market share.”

Analysts expect China to keep pouring billions into the chip race, as the consequences of being left behind could be fatal to its ambitions in fast-growing fields like AI.

“The scale of the subsidies is massive, far beyond what people would usually think,” said Dylan Patel, founder of the research group SemiAnalysis. “They’ll build apartment buildings, help with land and take no income taxes.”

China doesn’t have to establish self-sufficiency at each step of the semiconductor supply chain. The key is to create domestic alternatives at four or five steps of the process where the US and its allies can choke off supplies, says Clifford Kurz, an analyst with S&P Global Ratings. That means China — and Huawei — will likely focus on concentrated sectors like lithography, wafer production and electronic design automation, or EDA.

Sources: S&P Global Ratings and Kearney

“The key thing for Beijing is to have progress in these critical stages,” Kurz said. “They have done analysis of the whole supply chain since at least 2014. The purpose of the funding is to invest where they think they can have the most impact.”

Huawei founder Ren has had a complicated relationship with the Chinese government. For years, when the US pressed Western governments to ban Huawei’s telecom equipment out of concern it could be used to spy for the Communist Party, he maintained that his company had no special standing with the government.

Yet when his daughter, Huawei’s CFO, was detained in 2018 in Canada over US fraud allegations, Beijing went to extreme lengths to pressure the Canadian and American governments to free her. She was released in 2021 and returned to a hero’s welcome in China, suggesting the things Ren should be thankful to the Xi administration for include his daughter’s freedom.

Meng Wanzhou exits Supreme Court after a hearing in Vancouver, in 2021. Photographer: Darryl Dyck/Bloomberg

China owes him though too: Huawei’s “wolf culture” has kept them in the game. Indeed, as China targets independence throughout the semiconductor supply chain, there is one turn of phrase that keeps being used to describe the motivation of this grand push. It’s even part of the name of the taskforce that Beijing set up when Washington first blacklisted Huawei. Industry moguls and Chinese officials refer to that unit as 卡脖子办公室.

In an uncanny echo of Ren’s exhortation all those years ago, that phrase translates as “the office that solves neck choking problems.”

Reporting: Peter Elstrom and Allen Wan

Assistance: Gao Yuan

Graphics and design: Adrian Leung

Editing: Emily Cadman and Jane Pong

Additional photography: Johannes Eisele/AFP/Getty Images and James Park/Bloomberg

Terms of Service Do Not Sell or Share My Personal Information Trademarks Privacy Policy ©2023 Bloomberg L.P. All Rights Reserved

Careers

Made in NYC

Advertise Ad Choices Help

Nitazidi kukuletea habari, uchambuzi na matukio mbalimbali kuhusu huu ushindani wa U.S.A na China upande wa teknolojia, biashara na uchumi stay stuned.

Subscribe

China Secretly Transforms Huawei Into Most Powerful Chip War Weapon

The government is increasingly relying on Huawei — the company Washington tried to destroy — to lead the country’s efforts to build an independent semiconductor ecosystem.By Bloomberg News

December 1, 2023, 7:30 AM GMT+3

Share this article

Gift this article

Less than five years after US sanctions nearly crippled Huawei Technologies Co., the Chinese giant is now Beijing’s most important weapon in a battle over semiconductors that’s poised to shape the world economy for decades to come.

Huawei’s role in China’s chip industry goes far beyond what’s been previously reported. As well as being the most important customer for chip producers and the country’s leading chip designer, Huawei is increasingly lending engineering expertise and financial support to smaller companies in strategic areas of the chip supply chain. It often does this without disclosing its involvement — which would trigger US restrictions.

State support for the company has also reached unprecedented levels. Bloomberg News has uncovered a network of enterprises backed by a Shenzhen city government investment fund, which is focused on helping Huawei build a self-sufficient chip network. This group includes optical specialists, chip equipment developers and chemical manufacturers. This is in addition to the $30 billion state-sponsored endeavor to help Huawei build chip fabrication facilities Bloomberg News first reported on in August.

Building a Self-Sufficient Chip Network

A state investment fund is the linchpin of efforts to bolster HuaweiSource: Bloomberg reporting

“Huawei is now the centerpoint,” said Kendra Schaefer, a partner at Beijing-based consultancy Trivium China. “The export controls have pushed the state and industry together in a way we haven’t seen before.”

Huawei denied that the government is giving it support to develop semiconductor technologies. “This is entirely speculation and conjecture based on information online,” the company said in a statement.

The decision to make Huawei the effective captain of China’s effort to develop a self-sufficient chip industry is the result of a direct order from the top of government, according to people familiar with the matter who asked not to be named due to the sensitivity of the topic.

In Huawei, they have a rare national champion with the grit, scale and technological prowess to push back. Founded in 1987, the company first made its mark in the communications equipment industry before it later expanded into mobile phones. And its combative founder Ren Zhengfei was preparing for disaster years before it struck.

Huawei has long kept a group of black swans on its main campus as a reminder to avoid complacency and prepare for unexpected crises. More than a decade ago, when business was booming, Ren told engineers that continued investment in semiconductor research was the only way to head off a mortal threat to the company. “We can’t just let others to choke us and die just because of that one product,” Ren said.

Ren, founder and chief executive officer of Huawei. Photographer: Qilai Shen/Bloomberg

In the ensuing fight for survival after the US blacklisting in 2019, Ren moved as many as 10,000 developers onto 24-hour shifts in a race to redesign its circuit boards and software so they could function without American technology. At the busiest times, some staff didn’t set foot out of its Shenzhen campus for days, living on instant noodles and sleeping in chairs.

That all-out effort kept the company in business. Around this time, the Chinese state also began to step up its support, paving the way for today’s interdependent relationship.

To see how deeply Huawei and the Chinese government are now entwined, look no further than the launch in August of the new Mate 60 Pro smartphone. Huawei timed the release of the phone to coincide with US Commerce Secretary Gina Raimondo’s visit to China in part because of direct encouragement from a senior official at the top of the regime, according to a person familiar with the situation who asked not to be identified discussing sensitive matters. They’d decided it was time China showed some muscle, the person said.

The $900 smartphone signaled China’s rapid advance. Source: Bloomberg

The request surprised Huawei, which had planned to release the phone at a later date, said a different person. And while the company made the launch date, there was no time for the normal pizazz — or even a proper press event.

Huawei denied that government officials had asked for the Mate 60 Pro phone to be introduced sooner than originally planned.

The significance of the phone was the high proportion of advanced made-in-China components it contained, in particular a 7-nanometer processor from Shanghai’s Semiconductor Manufacturing International Corp. Hailed by state press as a patriotic triumph, it sparked fervent debate within the US about whether its efforts to slow China’s technological advance were falling short.

Huawei’s Breakthrough Phone

A teardown conducted for Bloomberg News found the majority of components in Huawei’s Mate 60 were made in China*Components with multiple suppliersSources: TechInsights and Bloomberg reporting

The concern in Washington is that the advanced semiconductors that power Huawei’s smartphones could also be used for military applications, such as AI-controlled drones or super computers for code-breaking and surveillance. The US is determined to contain China’s defense capabilities as tensions between the two countries rise over issues including the future of Taiwan.

At the center of the network of state enterprises that is assisting Huawei is an investment fund operated by the municipal government of Shenzhen, where Huawei is headquartered. The Shenzhen Major Industry Investment Group Co. was created in 2019 with state capital and given direct orders to support China’s chip efforts and Huawei specifically, according to people familiar with the matter.

It has invested in about a dozen companies in the supply chain, including three Huawei-linked chip fabrication facilities, according to data from Tianyancha, an online platform that provides company registration information. But perhaps its most significant operation is a chipmaking tool company called SiCarrier Technology Ltd., founded in 2021.

SiCarrier has formed a close, symbiotic relationship with Huawei, where it mainly interfaces with the electronic giant’s internal research arm, known as the 2012 Lab. Ren named it after Roland Emmerich’s doomsday film that saw China succeed, when nobody else could, in building vast arks to ride out a planet-wide natural disaster.

Huawei's research and development campus in Dongguan boasts manicured grounds and European style buildings. Photographer: Qilai Shen/Bloomberg

Huawei's Shenzhen headquarters from the above. Photographer: Qilai Shen/Bloomberg

The exchange of talent goes both ways. SiCarrier is vigorously hiring elite engineers to work directly on Huawei’s projects in Shenzhen and Dongguan, according to a person familiar with the matter. (The recruits are told not to reveal who they actually work for.)

Huawei has also transferred about a dozen patents to SiCarrier, including sound-proof technologies for electronic machines and data center designs, according to patent transfer information published by the China National Intellectual Property Administration. Huawei said any suggestion it has an in-depth partnership with SiCarrier to collaborate on chip technologies is “inconsistent with the facts.” Shenzhen Major Industry Investment Group, SiCarrier and its affiliates didn't respond to requests for comment.

SiCarrier operates out of a number of locations around Shenzhen. It has an office in an industry park affiliated with the Chinese Academy of Sciences, and another facility on the top floor of a six-story building inside a small industrial park in Shenzhen’s eastern suburbs. The facility makes components for semiconductor manufacturing equipment, including laser-driven light source gears, pressure control valves, and pumps, according to an evacuation map on the wall. Next to the map are three posters in Chinese with the words Trust, Innovation and Professionalism printed in bold white characters.

Outside SiCarrier’s facility in the eastern suburbs of Shenzhen. Source: Bloomberg

Its importance to Huawei is as far more than just a manufacturer, said people familiar with the relationship: SiCarrier is also a nexus between Huawei and the rest of the supply chain. For example, it’s the largest shareholder in optical machine maker Zetop Technologies Co., according to Tianyancha. Such technology is central to the production of microchips, which are built of layer upon layer of transistors bound to a silicon wafer. The key to this is a process known as lithography where light is projected through a blueprint of the pattern that will be printed.

Zetop’s second biggest shareholder is Changchun Institute of Optics, Fine Mechanics and Physics. An affiliate of the elite Chinese Academy of Sciences, it boasts of developing some of China’s best optical technologies for lithography machines.

Lithography is a particularly crucial area because Dutch company ASML Holding NV has a monopoly on extreme ultraviolet lithography gear — needed to make the most advanced chips — and has never sold those machines to China. With the imposition of US sanctions, ASML will also stop selling Chinese customers most deep ultraviolet equipment, slightly less sophisticated machines for manufacturing semiconductors.

Employees assemble a lithography machine at the ASML Holding NV factory in Veldhoven, Netherlands. Source: ASML Holding NV

Following its blacklisting, Huawei has hired a number of former ASML employees to help work on chipmaking machines, according to one person familiar with the matter and social media records. Bloomberg News found LinkedIn profiles of five former ASML staff members — including two previously based in the Netherlands — who said they joined Huawei between 2021 and 2022. None responded to requests for comment.

While it will be a long slog to fully catch-up — EUV equipment took the West decades and hundreds of millions of dollars to develop — the release of the Mate 60 smartphone suggests the gigantic effort centered on Huawei is making progress.

A specialist disassembles a Huawei Mate 60 Pro smartphone and removes the Kirin 9000s chip. Photographer: James Park/Bloomberg

Huawei never disclosed technical details, but a teardown of the handset conducted by TechInsights for Bloomberg News found it was powered by SMIC’s advanced 7-nanometer processor. That suggests China is roughly five years behind the current most advanced technology. Export controls imposed by the Biden administration in 2022 were aimed at keeping China at least eight years behind.

Huawei is getting a commercial boost too. The launch of the Mate 60 Pro reinvigorated its devices business, with analysts expecting the handset's sales to soar to 40 million to 60 million units next year.

“More government subsidies will make it even harder for Huawei to portray itself as independent. But subsidies will also let Huawei sell products at lower prices,” said Chris Miller, author of Chip War: The Fight for the World’s Most Critical Technology. “In many emerging markets, this will probably enable Huawei to win market share.”

Analysts expect China to keep pouring billions into the chip race, as the consequences of being left behind could be fatal to its ambitions in fast-growing fields like AI.

“The scale of the subsidies is massive, far beyond what people would usually think,” said Dylan Patel, founder of the research group SemiAnalysis. “They’ll build apartment buildings, help with land and take no income taxes.”

China doesn’t have to establish self-sufficiency at each step of the semiconductor supply chain. The key is to create domestic alternatives at four or five steps of the process where the US and its allies can choke off supplies, says Clifford Kurz, an analyst with S&P Global Ratings. That means China — and Huawei — will likely focus on concentrated sectors like lithography, wafer production and electronic design automation, or EDA.

Semiconductor Supply Chain Bottlenecks for China

The US dominates in chip design. Market share by value and region, 2023Sources: S&P Global Ratings and Kearney

“The key thing for Beijing is to have progress in these critical stages,” Kurz said. “They have done analysis of the whole supply chain since at least 2014. The purpose of the funding is to invest where they think they can have the most impact.”

Huawei founder Ren has had a complicated relationship with the Chinese government. For years, when the US pressed Western governments to ban Huawei’s telecom equipment out of concern it could be used to spy for the Communist Party, he maintained that his company had no special standing with the government.

Yet when his daughter, Huawei’s CFO, was detained in 2018 in Canada over US fraud allegations, Beijing went to extreme lengths to pressure the Canadian and American governments to free her. She was released in 2021 and returned to a hero’s welcome in China, suggesting the things Ren should be thankful to the Xi administration for include his daughter’s freedom.

Meng Wanzhou exits Supreme Court after a hearing in Vancouver, in 2021. Photographer: Darryl Dyck/Bloomberg

China owes him though too: Huawei’s “wolf culture” has kept them in the game. Indeed, as China targets independence throughout the semiconductor supply chain, there is one turn of phrase that keeps being used to describe the motivation of this grand push. It’s even part of the name of the taskforce that Beijing set up when Washington first blacklisted Huawei. Industry moguls and Chinese officials refer to that unit as 卡脖子办公室.

In an uncanny echo of Ren’s exhortation all those years ago, that phrase translates as “the office that solves neck choking problems.”

Reporting: Peter Elstrom and Allen Wan

Assistance: Gao Yuan

Graphics and design: Adrian Leung

Editing: Emily Cadman and Jane Pong

Additional photography: Johannes Eisele/AFP/Getty Images and James Park/Bloomberg

More On Bloomberg

Terms of Service Do Not Sell or Share My Personal Information Trademarks Privacy Policy ©2023 Bloomberg L.P. All Rights Reserved

Careers

Made in NYC

Advertise Ad Choices Help

Nitazidi kukuletea habari, uchambuzi na matukio mbalimbali kuhusu huu ushindani wa U.S.A na China upande wa teknolojia, biashara na uchumi stay stuned.

2023 Bloomberg L.P. All Rights Reserved

2023 Bloomberg L.P. All Rights Reserved