Geza Ulole

JF-Expert Member

- Oct 31, 2009

- 59,221

- 79,514

- Thread starter

- #141

Uganda Picks Four Firms For New Oil Exploration Round

By Irina Slav - Jun 04, 2021, 9:30 AM CDTUganda has shortlisted four companies for an exploration round following its second oil exploration tender ever. The tender involved five oil blocks along Uganda’s border with Congo, where oil has already been discovered, Dow Jones reports.

The companies include France’s Total—which recently changed its name to TotalEnergies—Australian DGR Global, Nigerian PetrolAfrik Energy Resources, and Uganda’s state-owned National Oil Co.

Total has had a presence in Uganda for five years after it was awarded a license to develop several fields that are currently the only producing fields in the country. These are estimated to contain some 6.5 billion barrels of crude. Total is developing them in partnership with Chinese CNOOC.

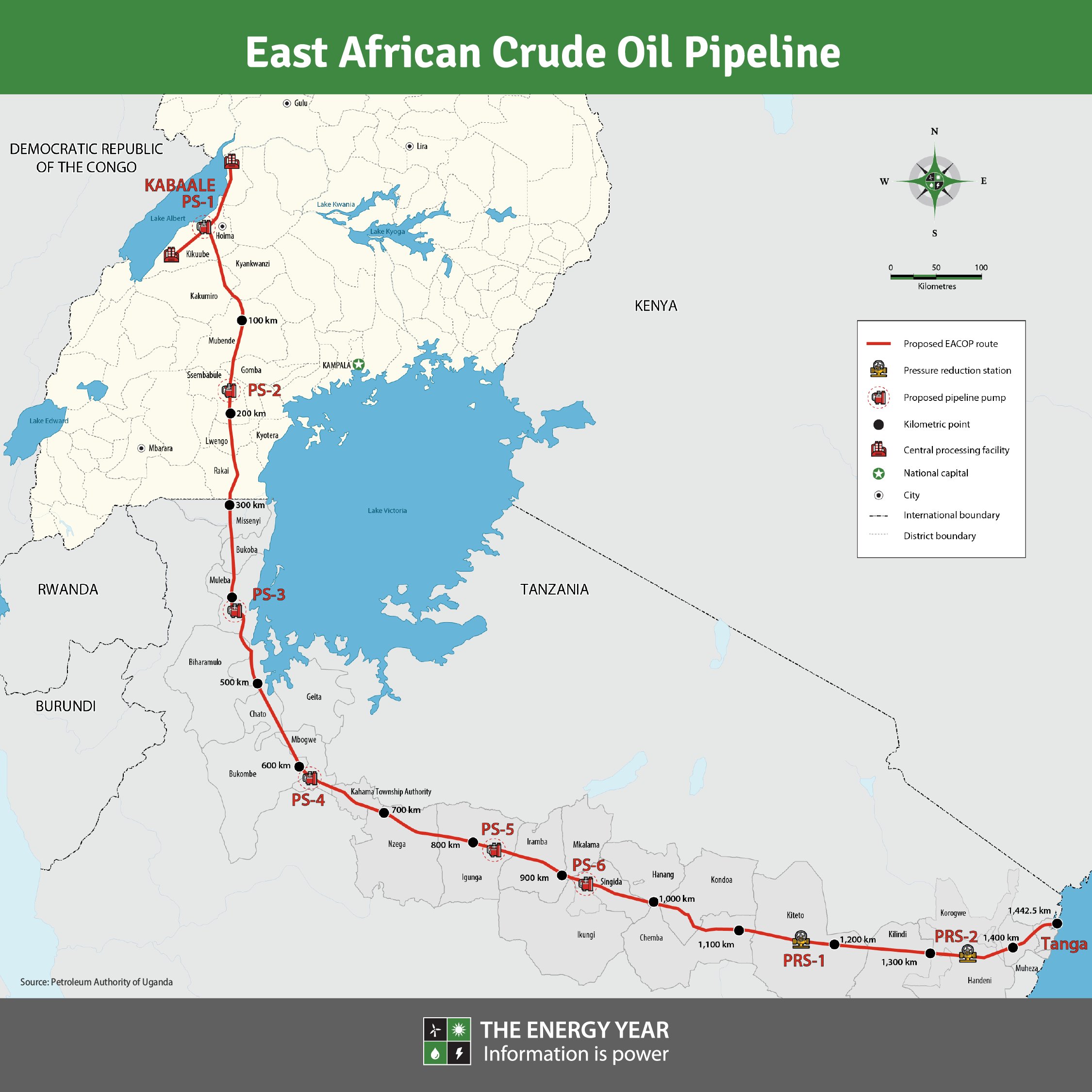

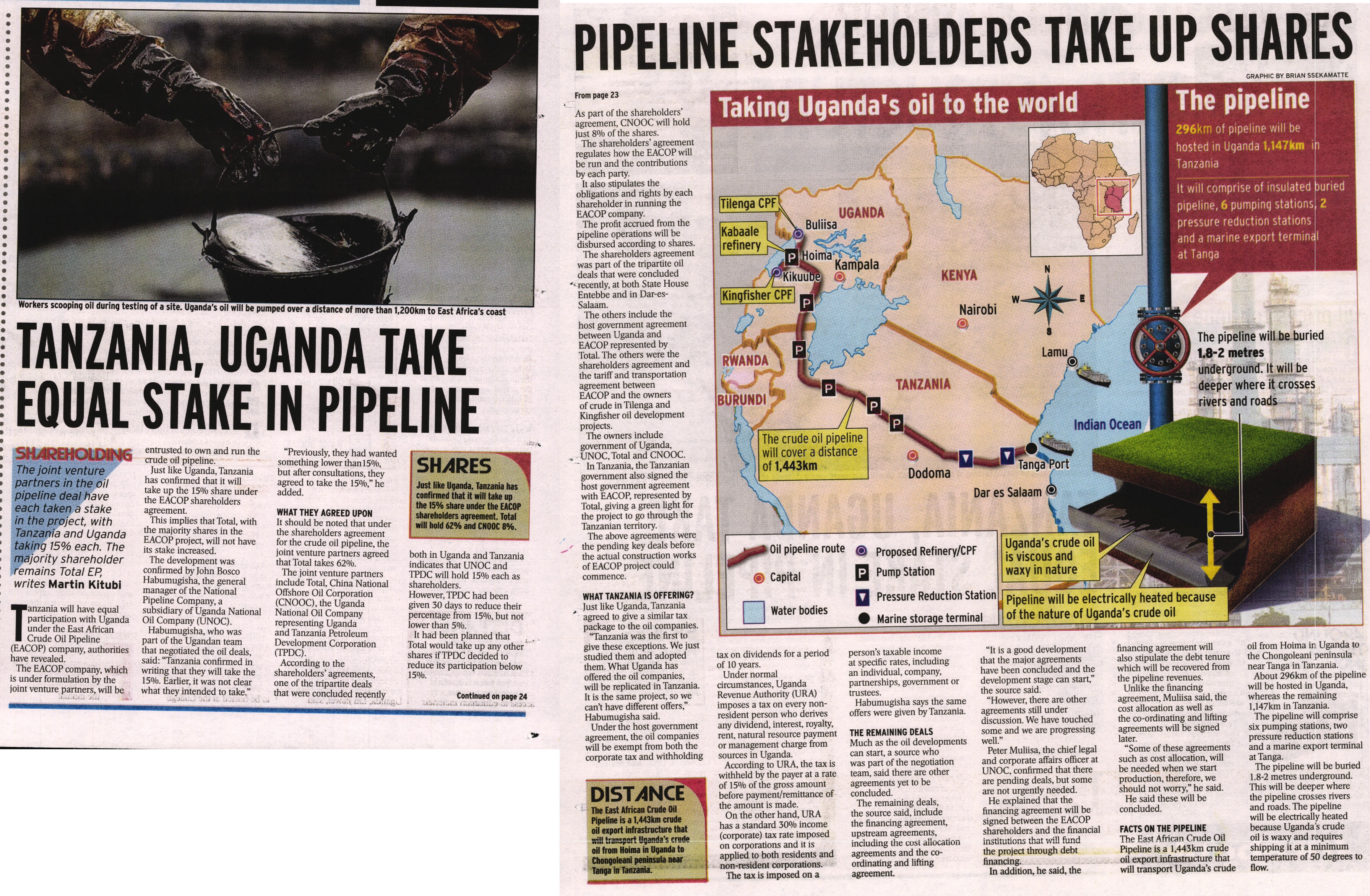

The French supermajor is also participating in the East-African Crude Oil Pipeline (EACOP) project: a 1,443 kilometer-long (897 miles) pipeline expected to transport oil from Uganda to the Tanga port in Tanzania. Total’s subsidiary, Total East Africa Midstream, is the developer of the project.

The pipeline, which will be the largest in Africa, is part of Uganda’s comprehensive plan to develop its oil resources. Later this year, the government plans to launch tenders for the construction work on the infrastructure along with a refinery.

On the production side, Total and CNOOC earlier this year inked a deal with the Ugandan and Tanzanian authorities to advance production at the Lake Albert project, which currently involves two fields. Production from these is seen at 230,000 bpd when it reaches its plateau, according to Total.

Uganda is a newcomer to the oil world but an ambitious one. These ambitions have understandably sparked criticism from environmentalist groups warning the pipeline project will wither never pay for itself because of declining oil consumption or contribute to climate change.

There have been doubts about the financing of the huge oil initiative in Uganda, too.

“Total and CNOOC still need to secure insurance and raise $2.5 billion in debt financing for the EACOP to move forward and they are going to struggle mightily to find enough banks and insurance providers willing to associate themselves with such a reckless project and assume its manifold risks on their books,” according to David Pred, Executive Director of Inclusive Development International, who also said on April“The oil companies are trying to dress up the investment decision signing ceremony, but fortunately this climate-destroying project is far from a done deal.”

By Irina Slav for Oilprice.com

Uganda Picks Four Firms For New Oil Exploration Round | OilPrice.com

Uganda has shortlisted four companies for an exploration round following its second oil exploration tender ever

Sasol intends to retain 20% stake in the pipeline. Credit: LoggaWiggler from Pixabay.

Sasol intends to retain 20% stake in the pipeline. Credit: LoggaWiggler from Pixabay.