Roving Journalist

JF Roving Journalist

- Apr 18, 2017

- 2,812

- 11,989

The international community has made the fight against money laundering and the financing of terrorism a priority. Among the goals of this effort are: protecting the integrity and stability of the international financial system, cutting off the resources available to terrorists, and making it more difficult for those engaged in crime to profit from their criminal activities. The IMF's unique blend of universal membership, surveillance functions, and financial sector expertise make it an integral and essential component of international efforts to combat money-laundering and the financing of terrorism.

In 2000, the Fund responded to calls from the international community to expand its work in the area of anti-money laundering (AML) in general and concerning the abuse of Offshore Financial Centers (OFC) in particular by initiating an OFC assessment program and exploring how it could incorporate AML work into its activities, especially Article IV surveillance and the newly-established Financial Sector Assessment Program (FSAP).1 Work on developing an AML Report on Standards and Codes (ROSC) module was ongoing when the tragic events of September 11, 2001 intensified the efforts and broadened their scope to include combating the financing of terrorism (CFT). Within about a year, the Fund was already actively at work assessing member countries compliance with the international standard developed (and subsequently fundamentally revised) by the Financial Action Task Force (FATF), as well as providing technical assistance on how to improve AML/CFT regimes. This preliminary experience was favorably evaluated by the Board, which in March, 2004, decided to incorporate AML/CFT assessments and AML/CFT technical assistance into the Fund's regular work and continue to make AML/CFT assessments a mandatory ROSC in every FSAP and OFC assessment.

The IMF is especially concerned about the possible consequences of money laundering and the financing of terrorism on its members' economies. These include risks to the soundness and stability of financial institutions and financial systems, increased volatility of international capital flows, and a dampening effect on foreign direct investment. The problem is global; money launderers and terrorist financiers exploit loopholes and differences among national AML/CFT systems and move their funds to or through jurisdictions with weak or ineffective legal and institutional frameworks.

The IMF is contributing to the international fight against money laundering and the financing of terrorism in several important ways, consistent with its core areas of competence. As a collaborative institution with near universal membership, the IMF is a natural forum for sharing information, developing common approaches to issues, and promoting desirable policies and standards -- all of which are critical in the fight against money laundering and the financing of terrorism. In addition, the IMF's broad experience in conducting financial sector assessments, providing technical assistance (TA) in the financial and nonfinancial sectors, and exercising surveillance over members economic systems is particularly helpful in evaluating country compliance with the international AML/CFT standards and in developing and implementing programs to assist member countries in addressing identified shortcomings.

Currently, the three main areas of IMF work in connection with AML/CFT are:

Assessments: Each evaluation of financial sector strengths and weaknesses conducted under the Financial Sector Assessment Program (FSAP) and the Offshore Financial Centers Program must include an assessment of the jurisdiction's AML/CFT regime. Such assessments measure compliance with the FATF 40+9 Recommendations according to an agreed Methodology for Assessing Compliance with the FATF 40+9 Recommendations also used by the Financial Action Task Force (FATF), the FATF-style regional bodies (FSRBs), and the World Bank in conducting their assessments;

Technical Assistance: Along with the World Bank, the IMF provides substantial technical assistance to member countries on strengthening their legal, regulatory, institutional and financial supervisory frameworks for AML/CFT; and

Policy Development: IMF and World Bank staff have been active in researching and analyzing international practices in implementing AML/CFT regimes as a basis for providing policy advice and technical assistance.

Anti-Money Laundering, Countering Terrorist and Proliferation Financing (AML-CFT-CFP) for Non Profit Organizations (NPOs)

AML-CFT Workshop Curriculum for NPOs

Module I - Violent Extremism and Operating Environment

Understanding the General Concept of Terrorism Operating Environments (Presentation by NCTC)

Understanding VE in TZ Context, identifying and Reporting the Early signs of VE in society

What are the threats posed by VEO to NPO and Society?

The activities of VEO

The fundamental effects of VE to NPO and Society

The environments VEO and NPO operate in society

Module II: Conceptualization of Risks in NPOs/NGOs

Conceptualization of TF, Money Laundering and Proliferation Risks

What are NGOs

What is Money Laundering

What is Terrorist Financing

What is Proliferation Financing

Targeted Financial Sanctions – Concept, Process and Implications

What is the link between money laundering and terrorist financing?

Understanding, Identifying and Reporting Early Signs

Module I

What is extremism?

any political or social theory that holds to uncompromising and rigid policies or ideology.

An extremist is a person who holds such uncompromising or rigid views or acts in a manner far beyond the norm.

What is the main cause of extremism?

A range of factors:

ideologies,

religious beliefs,

political beliefs and,

prejudices against particular groups of people.

Effects:

It Undermines:

peace and security,

human rights and,

sustainable development.

How do we Prevent Violent Extremism:

address the root causes of violent extremism through non-coercive approaches;

This is a collaborative approach;

Different actors deal with different levels and aspects of violent extremism;

NPOs are at the forefront of dealing with non-coercive approaches

The drivers of VE in TZ Context:

marginalized and discriminated populations – Extremists sell them the idea that the are NO viable, nonviolent means of alleviating grievances.

Religious Illiteracy – facilitate recruitment and provide justification for violence as a ‘religious proposition’

Economic deprivation - children and youth feeling hopeless in making it in their communities – It leads to vulnerable youth “Street children’ and equally frustrated parents.

Lack of social engagement mechanisms in communities for edgy youths, making them feel isolated and worthless – an easy ‘prey’ for extremists recruiters (sense of self worth, financial reward);

Many parents are too busy with the ‘realities’ of life to timely report these early signs to authorities;

In most instances, there is little awareness on the part of parents on the existing mechanisms for reporting;

Local leaders are yet to achieve such credibility for what ar considered ‘family issues’;

Current efforts to engage citizens through regular meetings still at infancy stage.

The recognition of community structures to deal with such issues need to bolstered with stakeholder engagements.

VEO and NPO operate in the same environment (society country) with different obligations and objectives;

NPO are for peace to support society and Govt to bring peace and harmony:-

Through social and economic engagement support to community

NPO Support to alleviate poverty by doing so prevents VE

NPOs are legally operating their activities and are govt stakeholders to prevent VE

VEO on the other hand, are operating in society in order to:

Create fear to general public

Disturb the existing peace and security in society/country

Prevent all social, economic and political developments

Radicalize, spread propaganda on their agenda

It is important to identify and tackle the drivers of VE

It is a collaborative effort

NPOs are an important component of that collaboration

Conceptualization of TF, Money Laundering and Proliferation Risks

What are NGOs

What is Money Laundering

What is Terrorist Financing

What is Proliferation Financing

Targeted Financial Sanctions – Concept, Process and Implications

What is the link between money laundering and terrorist financing?

Conceptualization of Risks in NPOs/NGOs

Module II: i) What are NGOs

What is a FATF NPOs

As per the FATF, a Non-Profit Organization (NPO) refers to a legal person or a legal arrangement or organisation that primarily engages in raising or disbursing funds for purposes such as charitable, religious, cultural, educational, social or fraternal purposes, or for the carrying out of other types of “good works”.

Conceptualization of Risks in NPOs/NGOs

Module II: i) What are NGOs

What is a FATF NPOs

As per the FATF, a Non-Profit Organisation (NPO) refers to a legal person or a legal arrangement or organisation that primarily engages in raising or disbursing funds for purposes such as charitable, religious, cultural, educational, social or fraternal purposes, or for the carrying out of other types of “good works”.

Identification of NPOs

Legal forms that exist in URT

NPOs from the following thematic areas are predominantly FATF NPOs:

i) Health

ii) Social protection

iii) Community empowerment

iv) Agriculture

v) Education

Module II: i) What are NGOs

'Non Governmental Organization'' also known in its acronym "NGO'' means a voluntary grouping of individuals or organization which is autonomous, non-partisan, non-profit making which is Organized locally at the grassroot, national or international levels for the purpose of enhancing or Promoting economic, environmental, social or cultural development or Protecting environment, lobbying or advocating on issues of public interest of a group of individuals or organization, and includes a Non-Governmental Organization, established under the auspices of a any religious Organization or faith Propagating organization' trade union, sports club, Political party, or commu_ nity based Organization; but does not include a trade, union, a social club or a sports club, a political Party, a religious Organization or a community based organization;

The Non-Governmental Organizations Act, 2002, Sect 2, Interpretation

What is Money Laundering

Activity connected with the proceeds of crime & projecting it as untainted property

Involves disguising the true origin of illegitimate funds

Converts illegally obtained income into other forms to appear it as a legitimate income

Mode to insert dirty money in the financial system.

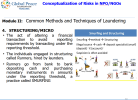

Module II: Common Methods and Techniques of Laundering

1. CASH SMUGGLING

Criminals may choose to remove their illicit assets from banks in order to break the audit trail by transporting to other regions or countries to spend or reintroduce into the banking system.

Tanzania is cash economy country that’s makes smuggling cash as significant threat to banks.

2015 Tanzania passed the regulation(AML) for declaring cash at airport to address cash smuggling.

2. MOBILE BANKING/PAYMENTS

Mobile Payments never had the same level of KYC due diligence that banks have;

Mobile users can register with different information.

Criminals and individuals can go unchecked through mobile transactions.

Cybercrime vulnerability also easier in mobile transactions.

SIM Card users registration made mandatory by TCRA.

ML/TF/PF are serious transnational organized crimes

AM/CTF/CPF efforts require close cooperation and coordination among stakeholders in order to succeed

What is Terrorist Financing

Terrorist financing involves the solicitation, collection or provision of funds with the intention that they may be used to support terrorist acts or organizations.

Funds may stem from both legal and illicit sources.

The primary goal of individuals or entities involved in the financing of terrorism is therefore not necessarily to conceal the sources of the money but to conceal both the financing and the nature of the financed activity.

Module II: Stages of Terrorism Financing

Raising Funds

Transferring Funds

Utilization of the Funds

What is Proliferation Financing

Financing of proliferation of weapons of mass destruction means providing financial or any other help to persons or jurisdictions that are under the United Nations (UN) embargo for producing, weapons of mass destruction (atomic, nuclear, biological, etc. weapons) illegally.

Currently (2023), Iran and the Democratic People’s Republic of Korea (DPRK) are under such embargo.

Targeted Financial Sanctions

A party may be designated for Targeted Financial Sanctions (TFS) by:

The United Nations Security Council or any of its sub committees acting under Chapter VII of the Charter of the United Nations (Security Council)

The Minister responsible for home affairs in the United Republic of Tanzania (URT)

Designations by Security Council

Designations by Security Council are Applicable in URT

Security Council designations shall have effect in URT immediately whereby, TFS in Reg. 19, 20, 25, 26 shall have immediate effect until delisting of the party by Security Council

Targeted sanctions are intended to be directed at individuals, companies and organizations, or restrict trade with key commodities.

The following instruments can be applied:

Financial sanctions (freezing of funds and other financial assets, ban on transactions, investment restrictions)

How to search for Sanctioned Entities:

Through the FIU Website at Tanzania Financial Intelligence Unit - Kitengo cha Kudhibiti Fedha Haramu Or

Straight to UNSC at: United Nations Security Council |

Link Between ML and Terrorist Financing

Money laundering and terrorist financing are both serious criminal offences.

The techniques used to launder money are essentially the same as those employed to conceal the sources and uses of terrorist funds.

TF and ML are processes that overlap, and money that has been laundered may be used as terrorist funds.

Both exploit the same vulnerabilities in financial systems, allowing for anonymity and non-transparency in executing financial transactions.

Terrorists use techniques like those of money launderers to evade authorities’ attention and protect the identity of their sponsors and the ultimate beneficiaries of the funds.

The most basic difference between TF and ML involves the origin of the funds.

TF uses funds for an illegal political purpose, but the money is not necessarily derived from illicit proceeds.

While ML always involves the proceeds of illegal activity.

The source of the funds is an important distinction between ML and TF.

The source of the funds in ML will be criminal activity

The source of the funds is largely irrelevant in TF

THE GREATER CONCERN IS WHERE THE MONEY GOES AND WHO IT SUPPORTS.

Terrorist funds can come from a variety of sources, both illegal and legal.

Conceptualization of TF, Money Laundering and Proliferation Risks

What are NGOs

What is Money Laundering

What is Terrorist Financing

What is Proliferation Financing

Targeted Financial Sanctions – Concept, Process and Implications

What is the link between money laundering and terrorist financing?

Module III: The Role of NPOs In Preventing Terrorist Financing

Understanding the NPO/NGO and its Mandate

The Risk of TF in NPO Sector as per FATF

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

Understanding the NPO/NGO and its Mandate

Across the NPO fraternity, there are notable intentions and efforts by the NPO community to promote transparency within their operations and to prevent misuse of the sector by those wishing to support terrorist financing and terrorist organisations.

The NGO Act, 2002,

The Non-Governmental Organizations (Amendments) Regulations, 2019;

Registrar of NGOs;

NACONGO;

Other Global Stakeholders;

Understanding the NPO/NGO and its Mandate

FATF has identified five major ways in which NPOs are at risk of being involved in terrorist financing. These are:

The diversion of funds for terrorist causes/activities either by staff within or outside the NGOs;

NGOs becoming associated or affiliated with a terrorist or terrorist group;

False or Fictitious NGOs;

Abuse of NPO programs by manipulating the NGOs activities with terrorist ideologies;

Providing financial support, facilities or otherwise, aiding and abetting terrorist activities for recruitment

The Risk of TF in NPO Sector

Terrorist organisations and non-profit organisations have very different objectives, but often rely on similar logistical capabilities:

Funds, material, personnel and public influence are key resources for non-profit organisations (NPOs).

Most NPOs operate in amongst vulnerable people

Terrorist organisations seek the same resources to further their cause, which makes NPOs vulnerable for abuse by terrorists or terrorist networks.

The Risk of TF in NPO Sector

NPOs are at risk of being abused for terrorism through infiltration of terrorist organisations at the programme delivery level to promote their ideology;

It is not very difficult for Terrorists to create own NPOs delivering similar programmes as genuine NPOs;

Most NPOs lack the structure and knowledge to identify TF risks in their operations;

National NPO governance structures do not include TF risk reporting structures

The Risk of TF in NPO Sector

Globalization,

This has changed the way NPOs operate, drawing them into areas where terrorist networks probably operate.

Potentially, this creates interconnected financial and transportation networks that are of interest to terrorist organizations'.

The Risk of TF in NPO Sector

The large transitory workforce of NPOs, with an important portion of that workforce made up of volunteers.

Staff, and in particular volunteers, are often not engaged after a thorough background check.

NPOs face difficulties attracting and retaining personnel that have technical expertise in risk assessment, compliance and legal matters.

The Risk of TF in NPO Sector

The high level of public trust in the good work done by the NPO sector.

NPO activities are generally not scrutinised as consistently as other sectors.

Terrorist networks exploits this public trust by piggyback on the legitimate activities of an – unwitting – NPO, or by mimicking legitimate NPOs

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

Recommendations 1, 8 and 10

NPOs Defined

As per the FATF, a Non-Profit Organisation (NPO) refers to a legal person or a legal arrangement or organisation that primarily engages in raising or disbursing funds for purposes such as charitable, religious, cultural, educational, social or fraternal purposes, or for the carrying out of other types of “good works”.

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

FATF Recommendation 1 – Assessing Risks and Applying a Risk-Based Approach

Countries should identify, assess and understand the money laundering and terrorist financing risks for the country, and should take action … aimed at ensuring the risks are mitigated effectively.

Where countries identify lower risks, they may decide to allow simplified measures for some of the FATF Recommendations under certain conditions

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

Countries are assessed on effective compliance of all 40 Recommendations;

For countries to allow for simplified measures for some of the FATF Recommendations, certain conditions have to be met, including the fact that ML and TF risks are able to be identified, assessed, mitigated effectively and reported.

Lack of capacity in NPOs has been one of the reason of perceived hard stances on the part of ‘reporting persons’ to relax some of the stringent due diligence rules, imposed by their regulators

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

FATF Recommendation 8 - Non-Profit Organisations

Review of the adequacy of laws and regulations that relate to non-profit organisations which the country has identified as being vulnerable to terrorist financing abuse.

Countries should apply focused and proportionate measures, in line with the risk-based approach, to such non-profit organisations to protect them from terrorist financing abuse, including:

by terrorist organisations posing as legitimate entities by exploiting legitimate entities as conduits for terrorist financing, including for the purpose of escaping asset-freezing measures, and by concealing or obscuring the clandestine diversion of funds intended for legitimate purposes to terrorist organisations.

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

FATF has identified a category of NPOs (FATF NPOs) who are vulnerable to TF abuse;

National authorities have instituted a process to identify the NPOs at Risk.

This and other capacity building programmes seeks to provide the answers to the question:

To what extent, without disrupting or discouraging legitimate NPO activities, has the country applied focused and proportionate measures to such NPOs which the country has identified as being vulnerable to terrorist financing abuse, in line with the risk based approach?

In 2000, the Fund responded to calls from the international community to expand its work in the area of anti-money laundering (AML) in general and concerning the abuse of Offshore Financial Centers (OFC) in particular by initiating an OFC assessment program and exploring how it could incorporate AML work into its activities, especially Article IV surveillance and the newly-established Financial Sector Assessment Program (FSAP).1 Work on developing an AML Report on Standards and Codes (ROSC) module was ongoing when the tragic events of September 11, 2001 intensified the efforts and broadened their scope to include combating the financing of terrorism (CFT). Within about a year, the Fund was already actively at work assessing member countries compliance with the international standard developed (and subsequently fundamentally revised) by the Financial Action Task Force (FATF), as well as providing technical assistance on how to improve AML/CFT regimes. This preliminary experience was favorably evaluated by the Board, which in March, 2004, decided to incorporate AML/CFT assessments and AML/CFT technical assistance into the Fund's regular work and continue to make AML/CFT assessments a mandatory ROSC in every FSAP and OFC assessment.

The IMF is especially concerned about the possible consequences of money laundering and the financing of terrorism on its members' economies. These include risks to the soundness and stability of financial institutions and financial systems, increased volatility of international capital flows, and a dampening effect on foreign direct investment. The problem is global; money launderers and terrorist financiers exploit loopholes and differences among national AML/CFT systems and move their funds to or through jurisdictions with weak or ineffective legal and institutional frameworks.

The IMF is contributing to the international fight against money laundering and the financing of terrorism in several important ways, consistent with its core areas of competence. As a collaborative institution with near universal membership, the IMF is a natural forum for sharing information, developing common approaches to issues, and promoting desirable policies and standards -- all of which are critical in the fight against money laundering and the financing of terrorism. In addition, the IMF's broad experience in conducting financial sector assessments, providing technical assistance (TA) in the financial and nonfinancial sectors, and exercising surveillance over members economic systems is particularly helpful in evaluating country compliance with the international AML/CFT standards and in developing and implementing programs to assist member countries in addressing identified shortcomings.

Currently, the three main areas of IMF work in connection with AML/CFT are:

Assessments: Each evaluation of financial sector strengths and weaknesses conducted under the Financial Sector Assessment Program (FSAP) and the Offshore Financial Centers Program must include an assessment of the jurisdiction's AML/CFT regime. Such assessments measure compliance with the FATF 40+9 Recommendations according to an agreed Methodology for Assessing Compliance with the FATF 40+9 Recommendations also used by the Financial Action Task Force (FATF), the FATF-style regional bodies (FSRBs), and the World Bank in conducting their assessments;

Technical Assistance: Along with the World Bank, the IMF provides substantial technical assistance to member countries on strengthening their legal, regulatory, institutional and financial supervisory frameworks for AML/CFT; and

Policy Development: IMF and World Bank staff have been active in researching and analyzing international practices in implementing AML/CFT regimes as a basis for providing policy advice and technical assistance.

Anti-Money Laundering, Countering Terrorist and Proliferation Financing (AML-CFT-CFP) for Non Profit Organizations (NPOs)

AML-CFT Workshop Curriculum for NPOs

Module I - Violent Extremism and Operating Environment

Understanding the General Concept of Terrorism Operating Environments (Presentation by NCTC)

Understanding VE in TZ Context, identifying and Reporting the Early signs of VE in society

What are the threats posed by VEO to NPO and Society?

The activities of VEO

The fundamental effects of VE to NPO and Society

The environments VEO and NPO operate in society

Module II: Conceptualization of Risks in NPOs/NGOs

Conceptualization of TF, Money Laundering and Proliferation Risks

What are NGOs

What is Money Laundering

What is Terrorist Financing

What is Proliferation Financing

Targeted Financial Sanctions – Concept, Process and Implications

What is the link between money laundering and terrorist financing?

Understanding, Identifying and Reporting Early Signs

Module I

What is extremism?

any political or social theory that holds to uncompromising and rigid policies or ideology.

An extremist is a person who holds such uncompromising or rigid views or acts in a manner far beyond the norm.

What is the main cause of extremism?

A range of factors:

ideologies,

religious beliefs,

political beliefs and,

prejudices against particular groups of people.

Effects:

It Undermines:

peace and security,

human rights and,

sustainable development.

How do we Prevent Violent Extremism:

address the root causes of violent extremism through non-coercive approaches;

This is a collaborative approach;

Different actors deal with different levels and aspects of violent extremism;

NPOs are at the forefront of dealing with non-coercive approaches

The drivers of VE in TZ Context:

marginalized and discriminated populations – Extremists sell them the idea that the are NO viable, nonviolent means of alleviating grievances.

Religious Illiteracy – facilitate recruitment and provide justification for violence as a ‘religious proposition’

Economic deprivation - children and youth feeling hopeless in making it in their communities – It leads to vulnerable youth “Street children’ and equally frustrated parents.

Lack of social engagement mechanisms in communities for edgy youths, making them feel isolated and worthless – an easy ‘prey’ for extremists recruiters (sense of self worth, financial reward);

Many parents are too busy with the ‘realities’ of life to timely report these early signs to authorities;

In most instances, there is little awareness on the part of parents on the existing mechanisms for reporting;

Local leaders are yet to achieve such credibility for what ar considered ‘family issues’;

Current efforts to engage citizens through regular meetings still at infancy stage.

The recognition of community structures to deal with such issues need to bolstered with stakeholder engagements.

VEO and NPO operate in the same environment (society country) with different obligations and objectives;

NPO are for peace to support society and Govt to bring peace and harmony:-

Through social and economic engagement support to community

NPO Support to alleviate poverty by doing so prevents VE

NPOs are legally operating their activities and are govt stakeholders to prevent VE

VEO on the other hand, are operating in society in order to:

Create fear to general public

Disturb the existing peace and security in society/country

Prevent all social, economic and political developments

Radicalize, spread propaganda on their agenda

It is important to identify and tackle the drivers of VE

It is a collaborative effort

NPOs are an important component of that collaboration

Conceptualization of TF, Money Laundering and Proliferation Risks

What are NGOs

What is Money Laundering

What is Terrorist Financing

What is Proliferation Financing

Targeted Financial Sanctions – Concept, Process and Implications

What is the link between money laundering and terrorist financing?

Conceptualization of Risks in NPOs/NGOs

Module II: i) What are NGOs

What is a FATF NPOs

As per the FATF, a Non-Profit Organization (NPO) refers to a legal person or a legal arrangement or organisation that primarily engages in raising or disbursing funds for purposes such as charitable, religious, cultural, educational, social or fraternal purposes, or for the carrying out of other types of “good works”.

Conceptualization of Risks in NPOs/NGOs

Module II: i) What are NGOs

What is a FATF NPOs

As per the FATF, a Non-Profit Organisation (NPO) refers to a legal person or a legal arrangement or organisation that primarily engages in raising or disbursing funds for purposes such as charitable, religious, cultural, educational, social or fraternal purposes, or for the carrying out of other types of “good works”.

Identification of NPOs

Legal forms that exist in URT

NPOs from the following thematic areas are predominantly FATF NPOs:

i) Health

ii) Social protection

iii) Community empowerment

iv) Agriculture

v) Education

Module II: i) What are NGOs

'Non Governmental Organization'' also known in its acronym "NGO'' means a voluntary grouping of individuals or organization which is autonomous, non-partisan, non-profit making which is Organized locally at the grassroot, national or international levels for the purpose of enhancing or Promoting economic, environmental, social or cultural development or Protecting environment, lobbying or advocating on issues of public interest of a group of individuals or organization, and includes a Non-Governmental Organization, established under the auspices of a any religious Organization or faith Propagating organization' trade union, sports club, Political party, or commu_ nity based Organization; but does not include a trade, union, a social club or a sports club, a political Party, a religious Organization or a community based organization;

The Non-Governmental Organizations Act, 2002, Sect 2, Interpretation

What is Money Laundering

Activity connected with the proceeds of crime & projecting it as untainted property

Involves disguising the true origin of illegitimate funds

Converts illegally obtained income into other forms to appear it as a legitimate income

Mode to insert dirty money in the financial system.

Module II: Common Methods and Techniques of Laundering

1. CASH SMUGGLING

Criminals may choose to remove their illicit assets from banks in order to break the audit trail by transporting to other regions or countries to spend or reintroduce into the banking system.

Tanzania is cash economy country that’s makes smuggling cash as significant threat to banks.

2015 Tanzania passed the regulation(AML) for declaring cash at airport to address cash smuggling.

2. MOBILE BANKING/PAYMENTS

Mobile Payments never had the same level of KYC due diligence that banks have;

Mobile users can register with different information.

Criminals and individuals can go unchecked through mobile transactions.

Cybercrime vulnerability also easier in mobile transactions.

SIM Card users registration made mandatory by TCRA.

ML/TF/PF are serious transnational organized crimes

AM/CTF/CPF efforts require close cooperation and coordination among stakeholders in order to succeed

What is Terrorist Financing

Terrorist financing involves the solicitation, collection or provision of funds with the intention that they may be used to support terrorist acts or organizations.

Funds may stem from both legal and illicit sources.

The primary goal of individuals or entities involved in the financing of terrorism is therefore not necessarily to conceal the sources of the money but to conceal both the financing and the nature of the financed activity.

Module II: Stages of Terrorism Financing

Raising Funds

Transferring Funds

Utilization of the Funds

What is Proliferation Financing

Financing of proliferation of weapons of mass destruction means providing financial or any other help to persons or jurisdictions that are under the United Nations (UN) embargo for producing, weapons of mass destruction (atomic, nuclear, biological, etc. weapons) illegally.

Currently (2023), Iran and the Democratic People’s Republic of Korea (DPRK) are under such embargo.

Targeted Financial Sanctions

A party may be designated for Targeted Financial Sanctions (TFS) by:

The United Nations Security Council or any of its sub committees acting under Chapter VII of the Charter of the United Nations (Security Council)

The Minister responsible for home affairs in the United Republic of Tanzania (URT)

Designations by Security Council

Designations by Security Council are Applicable in URT

Security Council designations shall have effect in URT immediately whereby, TFS in Reg. 19, 20, 25, 26 shall have immediate effect until delisting of the party by Security Council

Targeted sanctions are intended to be directed at individuals, companies and organizations, or restrict trade with key commodities.

The following instruments can be applied:

Financial sanctions (freezing of funds and other financial assets, ban on transactions, investment restrictions)

How to search for Sanctioned Entities:

Through the FIU Website at Tanzania Financial Intelligence Unit - Kitengo cha Kudhibiti Fedha Haramu Or

Straight to UNSC at: United Nations Security Council |

Link Between ML and Terrorist Financing

Money laundering and terrorist financing are both serious criminal offences.

The techniques used to launder money are essentially the same as those employed to conceal the sources and uses of terrorist funds.

TF and ML are processes that overlap, and money that has been laundered may be used as terrorist funds.

Both exploit the same vulnerabilities in financial systems, allowing for anonymity and non-transparency in executing financial transactions.

Terrorists use techniques like those of money launderers to evade authorities’ attention and protect the identity of their sponsors and the ultimate beneficiaries of the funds.

The most basic difference between TF and ML involves the origin of the funds.

TF uses funds for an illegal political purpose, but the money is not necessarily derived from illicit proceeds.

While ML always involves the proceeds of illegal activity.

The source of the funds is an important distinction between ML and TF.

The source of the funds in ML will be criminal activity

The source of the funds is largely irrelevant in TF

THE GREATER CONCERN IS WHERE THE MONEY GOES AND WHO IT SUPPORTS.

Terrorist funds can come from a variety of sources, both illegal and legal.

Conceptualization of TF, Money Laundering and Proliferation Risks

What are NGOs

What is Money Laundering

What is Terrorist Financing

What is Proliferation Financing

Targeted Financial Sanctions – Concept, Process and Implications

What is the link between money laundering and terrorist financing?

Module III: The Role of NPOs In Preventing Terrorist Financing

Understanding the NPO/NGO and its Mandate

The Risk of TF in NPO Sector as per FATF

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

Understanding the NPO/NGO and its Mandate

Across the NPO fraternity, there are notable intentions and efforts by the NPO community to promote transparency within their operations and to prevent misuse of the sector by those wishing to support terrorist financing and terrorist organisations.

The NGO Act, 2002,

The Non-Governmental Organizations (Amendments) Regulations, 2019;

Registrar of NGOs;

NACONGO;

Other Global Stakeholders;

Understanding the NPO/NGO and its Mandate

FATF has identified five major ways in which NPOs are at risk of being involved in terrorist financing. These are:

The diversion of funds for terrorist causes/activities either by staff within or outside the NGOs;

NGOs becoming associated or affiliated with a terrorist or terrorist group;

False or Fictitious NGOs;

Abuse of NPO programs by manipulating the NGOs activities with terrorist ideologies;

Providing financial support, facilities or otherwise, aiding and abetting terrorist activities for recruitment

The Risk of TF in NPO Sector

Terrorist organisations and non-profit organisations have very different objectives, but often rely on similar logistical capabilities:

Funds, material, personnel and public influence are key resources for non-profit organisations (NPOs).

Most NPOs operate in amongst vulnerable people

Terrorist organisations seek the same resources to further their cause, which makes NPOs vulnerable for abuse by terrorists or terrorist networks.

The Risk of TF in NPO Sector

NPOs are at risk of being abused for terrorism through infiltration of terrorist organisations at the programme delivery level to promote their ideology;

It is not very difficult for Terrorists to create own NPOs delivering similar programmes as genuine NPOs;

Most NPOs lack the structure and knowledge to identify TF risks in their operations;

National NPO governance structures do not include TF risk reporting structures

The Risk of TF in NPO Sector

Globalization,

This has changed the way NPOs operate, drawing them into areas where terrorist networks probably operate.

Potentially, this creates interconnected financial and transportation networks that are of interest to terrorist organizations'.

The Risk of TF in NPO Sector

The large transitory workforce of NPOs, with an important portion of that workforce made up of volunteers.

Staff, and in particular volunteers, are often not engaged after a thorough background check.

NPOs face difficulties attracting and retaining personnel that have technical expertise in risk assessment, compliance and legal matters.

The Risk of TF in NPO Sector

The high level of public trust in the good work done by the NPO sector.

NPO activities are generally not scrutinised as consistently as other sectors.

Terrorist networks exploits this public trust by piggyback on the legitimate activities of an – unwitting – NPO, or by mimicking legitimate NPOs

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

Recommendations 1, 8 and 10

NPOs Defined

As per the FATF, a Non-Profit Organisation (NPO) refers to a legal person or a legal arrangement or organisation that primarily engages in raising or disbursing funds for purposes such as charitable, religious, cultural, educational, social or fraternal purposes, or for the carrying out of other types of “good works”.

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

FATF Recommendation 1 – Assessing Risks and Applying a Risk-Based Approach

Countries should identify, assess and understand the money laundering and terrorist financing risks for the country, and should take action … aimed at ensuring the risks are mitigated effectively.

Where countries identify lower risks, they may decide to allow simplified measures for some of the FATF Recommendations under certain conditions

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

Countries are assessed on effective compliance of all 40 Recommendations;

For countries to allow for simplified measures for some of the FATF Recommendations, certain conditions have to be met, including the fact that ML and TF risks are able to be identified, assessed, mitigated effectively and reported.

Lack of capacity in NPOs has been one of the reason of perceived hard stances on the part of ‘reporting persons’ to relax some of the stringent due diligence rules, imposed by their regulators

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

FATF Recommendation 8 - Non-Profit Organisations

Review of the adequacy of laws and regulations that relate to non-profit organisations which the country has identified as being vulnerable to terrorist financing abuse.

Countries should apply focused and proportionate measures, in line with the risk-based approach, to such non-profit organisations to protect them from terrorist financing abuse, including:

by terrorist organisations posing as legitimate entities by exploiting legitimate entities as conduits for terrorist financing, including for the purpose of escaping asset-freezing measures, and by concealing or obscuring the clandestine diversion of funds intended for legitimate purposes to terrorist organisations.

Discussions - FATF AML-CFT-CFP Recommendations Relevant to NPOs

FATF has identified a category of NPOs (FATF NPOs) who are vulnerable to TF abuse;

National authorities have instituted a process to identify the NPOs at Risk.

This and other capacity building programmes seeks to provide the answers to the question:

To what extent, without disrupting or discouraging legitimate NPO activities, has the country applied focused and proportionate measures to such NPOs which the country has identified as being vulnerable to terrorist financing abuse, in line with the risk based approach?

Attachments

-

1686730302082.png29.6 KB · Views: 1

1686730302082.png29.6 KB · Views: 1 -

1686730341117.png30.6 KB · Views: 1

1686730341117.png30.6 KB · Views: 1 -

1686730570096.png3.4 KB · Views: 1

1686730570096.png3.4 KB · Views: 1 -

1686730908533.png117.2 KB · Views: 1

1686730908533.png117.2 KB · Views: 1 -

1686731106465.png58.2 KB · Views: 2

1686731106465.png58.2 KB · Views: 2 -

1686731264749.png69.2 KB · Views: 2

1686731264749.png69.2 KB · Views: 2 -

1686731470413.png90.5 KB · Views: 2

1686731470413.png90.5 KB · Views: 2 -

1686732535270.png75.1 KB · Views: 1

1686732535270.png75.1 KB · Views: 1 -

1686734598478.png36.4 KB · Views: 1

1686734598478.png36.4 KB · Views: 1 -

1686734609934.png36.4 KB · Views: 1

1686734609934.png36.4 KB · Views: 1