Bavaria

JF-Expert Member

- Jun 14, 2011

- 53,097

- 53,479

Europe's banks have been a focal point of investor skittishness since Britons voted to leave the European Union, but reasons to be worried about financial firms pre-date the referendum.

Whether it be the mountain of non-performing loans, the challenge from fintech firms and alternative lenders encroaching on what was once their turf, or rock bottom interest rates eroding margins, the problems facing Europe's lenders are mammoth.

They're so vast that European Central Bank Vice President Vitor Constancio dedicated more than 8,000 words to the topic on Thursday. In his thinking, Europe's banks are "under siege."

Here are a few of the fronts in the battle:

Low rates

Banks face difficulties in increasing revenues during long periods of low interest rates and low growth. Rock bottom rates are resulting in diminished net interest margins.

NPLs

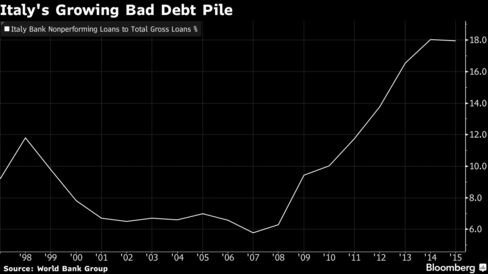

It's not just Italian banks that have bad loans. Large institutions across the euro area hold a combined total of nearly 950 billion euros ($1.05 trillion) of NPLs, which is equivalent to about 9 percent of GDP. The loans reduce profitability, consume capital, and tie-up resources.

Progress has been slow in cutting the NPL pile and the weight of 360 billion euros of soured loans in Italy threatens to be Europe's next headache.

Fintech

Start your day with what’s moving markets.

Get our markets daily newsletter.

Fintech — a broad label encompassing a variety of firms using software to provide financial services — threatens to take away market share in areas such as payment services and savings and investment management. Still, it is not a given that they will crowd out traditional lenders in a big way because banks will also adopt new technologies and defend their franchises, according to the ECB's Constancio.

Regulation, and more regulation

Regulation has been one of the few growth areas in the banking sector since the financial crisis with new rules on capital, liquidity, and leverage. Yet the post-crisis rewrite of the banking rulebook is still to be completed, with further areas of development to potentially cover treatment of sovereign exposures and bank resolution.

Adjusting existing rules and adding new ones is keeping banks on their toes. And it's not just securities rules: a populist political streak is not helping either.

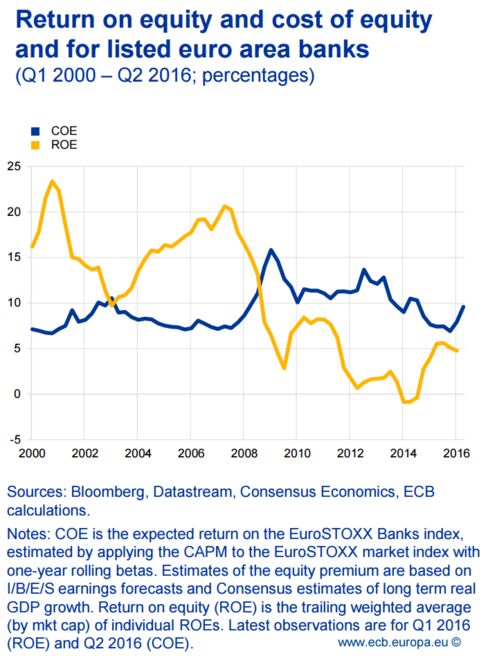

Low profitability

As a result of all of the above, Europe's banks are in a prolonged period of low profitability that looks unlikely to reverse any time soon. Profits at the region's largest lenders have been less than their cost of capital since the 2008 financial crisis, forcing a lengthy period of restructuring and retrenchment.

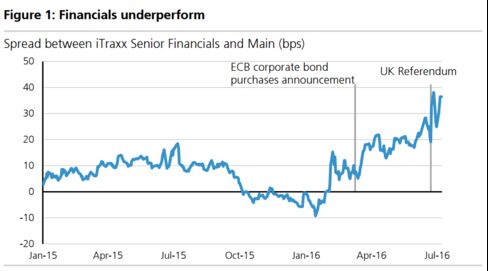

Skepticism over the potential for Europe's banks to boost profitability is driving pricing in equity and debt markets, with banks under-performing other sectors:

UBS

As UBS' Kathleen Middlemiss wrote:

Concerns around bank profitability have become the dominant driver of credit spreads on financials versus the broader market. The ability of banks to profitably conduct their principal function of maturity transformation is hindered by the low absolute level of interest rates, the difficulty in passing on negative rates to depositors, and the flatness of the curve.

So with banks looking cheap, is it time to buy bank securities? Or maybe buy a bank itself?

The Problem(s) With Europe's Banks