Tony254

JF-Expert Member

- May 11, 2017

- 16,017

- 16,427

KCB ni bank kubwa hapa Afrika Mashariki lakini sikuwa nafahamu historia yake. Hii bank ina historia ndefu na ya mafanikio makubwa.

Voyage Into East Africa

1893

After success in Pakistan, Burma, Ceylon and Aden, National Bank of India opens a new branch in India.

1890

Zanzibar -which has close trading links with India- and Pemba Islands become British protectorates. All revenues are administered by British officers.

1866

Process to turn the bank to a Sterling company commences. Some pioneers wanted a strictly Calcutta bank. Others wanted it to be an international institution.

1864

The banks name is changed to National Bank of India. A new branch is opened in Bombay and a proposal sent to the directors to open a banking agency in London.

1863

After a call to invest in a proposed bank – the Calcutta City Banking Corporation, it opens for business on the morning of November 16, 1863 at 1/1 Mission Row, Calcutta.

1904

The bank opens a branch in Nairobi in a small tin shack with an increase in trade activity, such as the opening of Indian bazaar.

1896

A branch of National Bank of India is opened in Mombasa owing to the thriving trade and The Imperial British East Africa Company opening new trading posts in the interior.

The Parsis, the Railway and the Journey to Nairobi

1908

The bank gets into a profitable agreement with the Uganda Railway to become its sole banker while the railway gets guaranteed rates of interest on its provident fund monies.

The Early Currency Exchange Struggles

2015

KCB Bank received an international credit rating from Moody’s and S&P rating agencies. B1 and B+ respectively and at par with the Kenya sovereign rating. Launch of KCB M-PESA, a mobile based account , offered exclusively to M-PESA customers. 5M accounts were opened during the year transacting over KES 259B. Launch of Representative office in Ethiopia

The Rise of the National and Grindlays

1962

The bank opens more branches in Nairobi and upcountry in preparation for a new set of customers; Africans.

1961

New branches are opened in Nairobi at Cargen House and in Karatina, replacing the temporary branch.

1957

The bank announces that the merger with Grindlays Bank scheduled for January 1, 1958, to form National Overseas and Grindlays Bank Ltd.

The Kenyatta Years

1968

The bank opens a new branch in Ukwala Siaya and appoints H.E. Odhiambo as the first manager.

Kenya Commercial Bank is Born

1977

The bank opens a new headquarters and the country’s economy is thriving, recording a surplus of Sh2.2 billion after payments

1977

KCB opens a new headquarters. The building today houses the Kenya National Archives.

1976

KCB buys Kipande House, which had been put up in 1910 and gazette as a national monument, on condition that it makes no alterations.

1971

President Kenyatta appoints former PS in the Ministry of Finance, John Michuki, as the chairman of the KCB board. The first general manager is P. B. Noble, the former Kenya manager of National and Grindlays Bank Ltd.

1972

Savings and Loan Kenya Limited becomes a KCB subsidiary after it acquires all its shares, formerly owned by the Pearl Assurance Company.

1970

In July the government signs deal to become a 60% shareholder, giving it a new name, Kenya Commercial Bank, with the motto ‘Being closer to the people’.

The Bank in the Moi Era

1987

The bank opens a special services branch at Harambee Plaza and launches guaranteed cheques aimed at current account customers.

1985

The bank launches a sports complex in Ruaraka, Nairobi. The bank also opens a new sub-branch in Sagana.

kcbgroup.com

kcbgroup.com

Our History

120+ Years of Progress

We are proud of our history and heritage which is rooted as far back as the nineteenth century. Take a look at how far we have come since our inception, back in 1896. Start scrolling to explore.Voyage Into East Africa

1893

After success in Pakistan, Burma, Ceylon and Aden, National Bank of India opens a new branch in India.

1890

Zanzibar -which has close trading links with India- and Pemba Islands become British protectorates. All revenues are administered by British officers.

1866

Process to turn the bank to a Sterling company commences. Some pioneers wanted a strictly Calcutta bank. Others wanted it to be an international institution.

1864

The banks name is changed to National Bank of India. A new branch is opened in Bombay and a proposal sent to the directors to open a banking agency in London.

1863

After a call to invest in a proposed bank – the Calcutta City Banking Corporation, it opens for business on the morning of November 16, 1863 at 1/1 Mission Row, Calcutta.

1904

The bank opens a branch in Nairobi in a small tin shack with an increase in trade activity, such as the opening of Indian bazaar.

1896

A branch of National Bank of India is opened in Mombasa owing to the thriving trade and The Imperial British East Africa Company opening new trading posts in the interior.

The Parsis, the Railway and the Journey to Nairobi

1908

The bank gets into a profitable agreement with the Uganda Railway to become its sole banker while the railway gets guaranteed rates of interest on its provident fund monies.

The Early Currency Exchange Struggles

2015

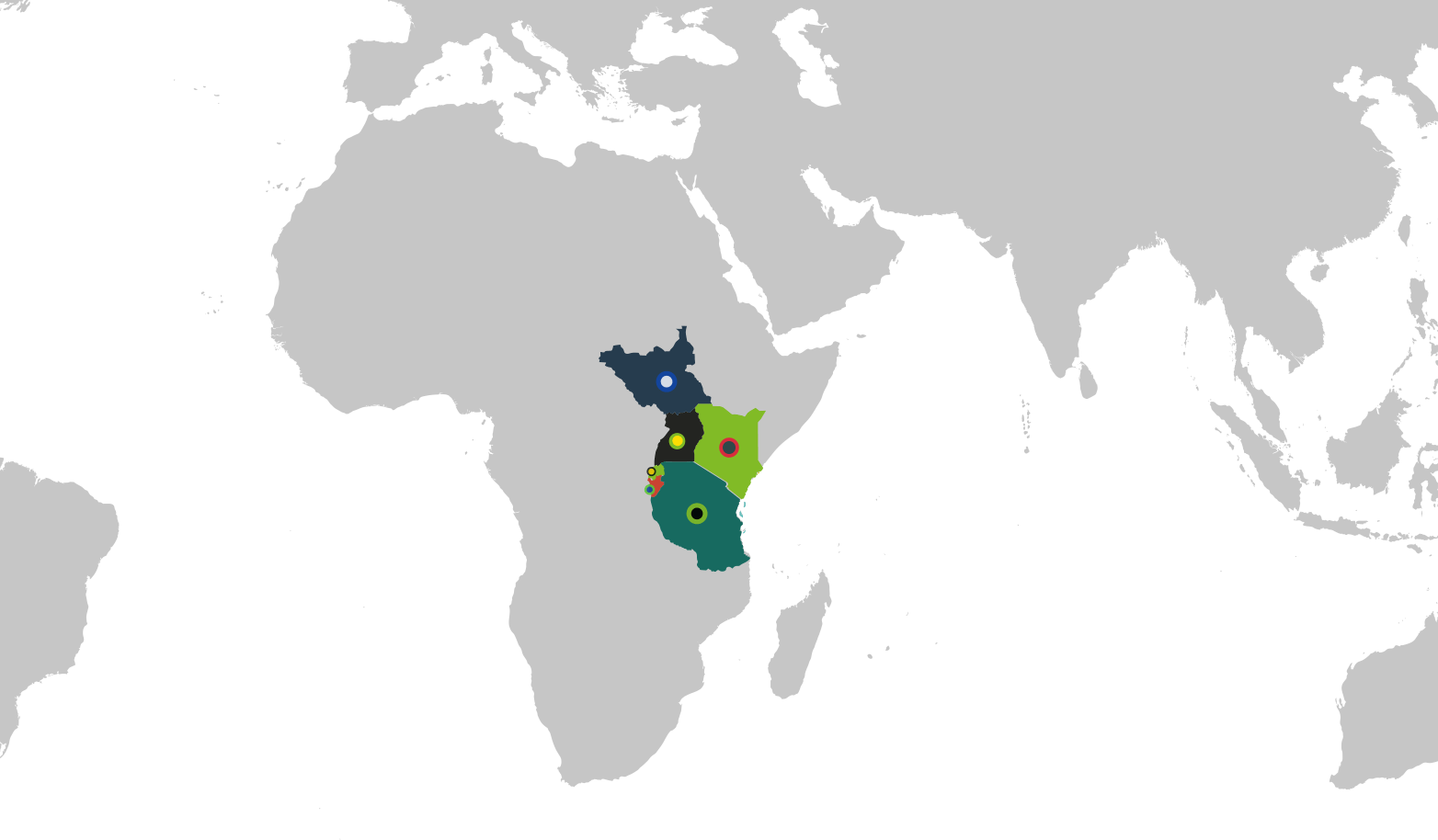

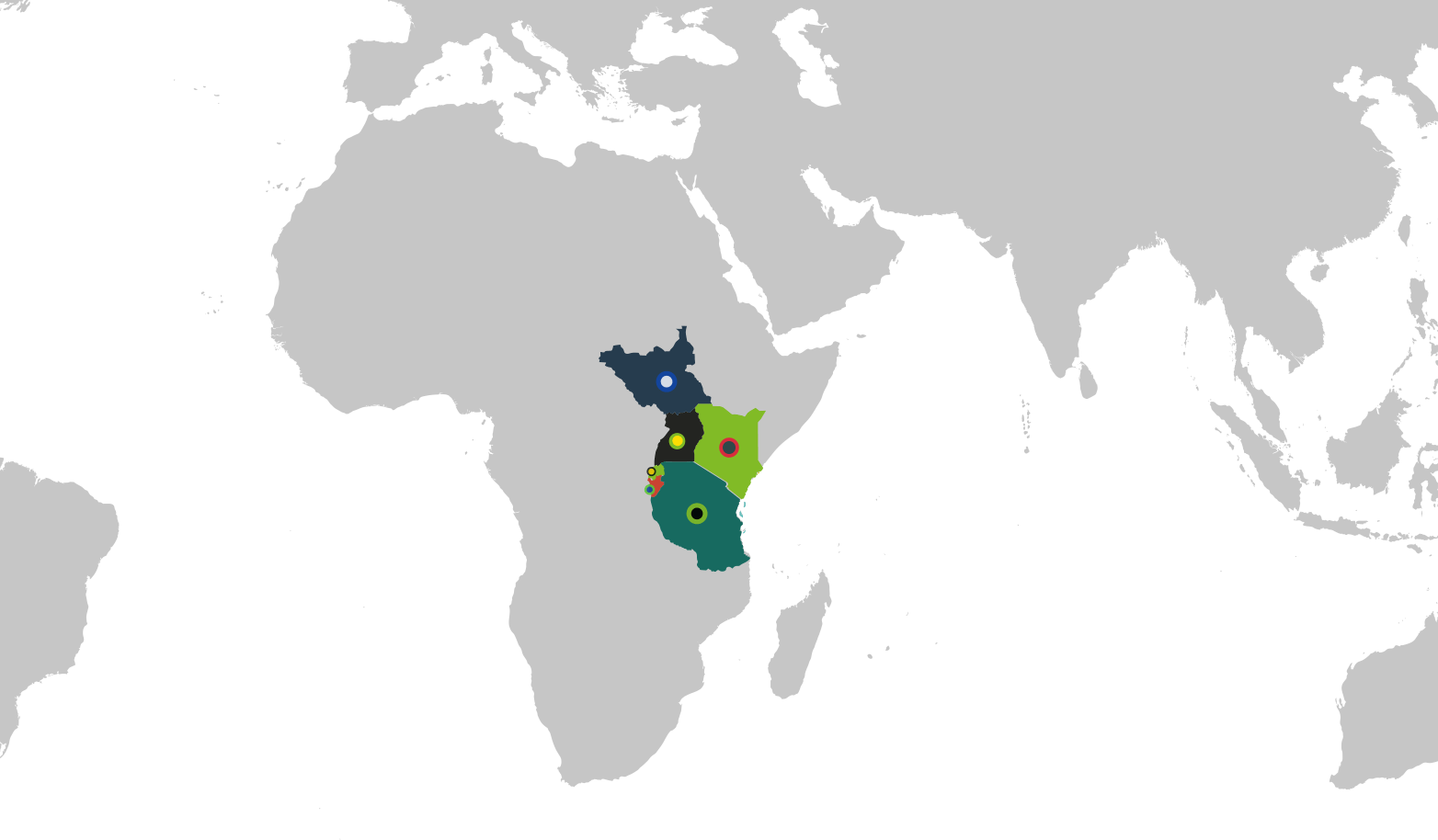

KCB Bank received an international credit rating from Moody’s and S&P rating agencies. B1 and B+ respectively and at par with the Kenya sovereign rating. Launch of KCB M-PESA, a mobile based account , offered exclusively to M-PESA customers. 5M accounts were opened during the year transacting over KES 259B. Launch of Representative office in Ethiopia

The Rise of the National and Grindlays

1962

The bank opens more branches in Nairobi and upcountry in preparation for a new set of customers; Africans.

1961

New branches are opened in Nairobi at Cargen House and in Karatina, replacing the temporary branch.

1957

The bank announces that the merger with Grindlays Bank scheduled for January 1, 1958, to form National Overseas and Grindlays Bank Ltd.

The Kenyatta Years

1968

The bank opens a new branch in Ukwala Siaya and appoints H.E. Odhiambo as the first manager.

Kenya Commercial Bank is Born

1977

The bank opens a new headquarters and the country’s economy is thriving, recording a surplus of Sh2.2 billion after payments

1977

KCB opens a new headquarters. The building today houses the Kenya National Archives.

1976

KCB buys Kipande House, which had been put up in 1910 and gazette as a national monument, on condition that it makes no alterations.

1971

President Kenyatta appoints former PS in the Ministry of Finance, John Michuki, as the chairman of the KCB board. The first general manager is P. B. Noble, the former Kenya manager of National and Grindlays Bank Ltd.

1972

Savings and Loan Kenya Limited becomes a KCB subsidiary after it acquires all its shares, formerly owned by the Pearl Assurance Company.

1970

In July the government signs deal to become a 60% shareholder, giving it a new name, Kenya Commercial Bank, with the motto ‘Being closer to the people’.

The Bank in the Moi Era

1987

The bank opens a special services branch at Harambee Plaza and launches guaranteed cheques aimed at current account customers.

1985

The bank launches a sports complex in Ruaraka, Nairobi. The bank also opens a new sub-branch in Sagana.

KCB Group Limited

KCB Group is registered as a non-operating holding company which started operations as a licensed banking institution with effect from January 1, 2016.