Bavaria

JF-Expert Member

- Jun 14, 2011

- 53,102

- 53,351

Since its commercial introduction in 2007, the Airbus A380 has brought a long-lost sense of glamour back to travel. Its first-class cabins feature private showers and buttery leather armchairs. It sports in-flight lounges where bartenders mix bespoke cocktails. A broad staircase reminiscent of a 1920s ocean liner links the two decks. Financially speaking, it’s a disaster of similarly grand proportions.

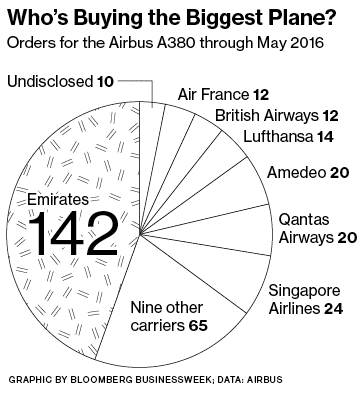

An initial flood of interest from airlines has turned into a slow drip, and Airbus is leaning heavily on one customer, Emirates, for sales. Not a single U.S. carrier has bought one, and Japanese airlines, among the biggest cheerleaders for huge planes, have taken just a handful.

Airbus has delivered 193 A380s—early on it predicted airlines would buy 1,200 supersize planes over two decades—and has only 126 in its order book, to be built over the next five years or so. Worse, many orders appear squishy, because airlines are shifting away from superjumbos. As the aviation world starts gathering on July 11 for the Farnborough International Airshow in England, where carriers often announce big orders, there’s little indication any A380 contract will be unveiled.

Airbus concedes its timing was off with the A380, which lists for $433 million but almost always sells at a discount. The financial crisis hit just as production was picking up in 2008, and soaring oil prices made airlines reluctant to buy the four-engine behemoth.

The company only last year managed to start breaking even on production, and it’s acknowledged it will never recoup the €25 billion ($32 billion) it spent on development. Zafar Khan, an analyst at Société Générale, says the concern is that if production slips far below 30 planes a year, the program could fall back into the red. “The crying happens when it’s losing money,” Khan says.

Axing the A380 outright is hard to do. Besides the embarrassment of admitting defeat on the program, Airbus would need to write off factories across Europe and redeploy thousands of workers. Airlines would see the resale value of their A380s plummet, and the plane’s demise would leave airports worldwide questioning the wisdom of facilities constructed to accommodate it; Dubai, for instance, built a dedicated terminal for the A380.

Airbus says 10 years is too short a time to determine its fate. While Chief Executive Officer Thomas Enders said in December the company would assess the plane’s future “in cold blood,” sales chief John Leahy has pledged to continue the program. “The A380 is here to stay,” he says. “We are maintaining, innovating, and investing in it.”

With its short snout and upper deck crouching above the cockpit, the A380 can’t match the distinctive profile of Boeing’s humpbacked 747. Nonetheless, the A380 has largely sucked the life out of Boeing’s jumbo—perhaps the biggest Airbus success with its plane. Since 2012, when Boeing started deliveries of the latest passenger version, the 747-8, it has done far worse than the Airbus double-decker, with just 40 sold and 11 more on order.

Four-engine planes have become a tough sell because of their high fuel consumption. Airbus in 2011 scrapped the A340, its other four-engine model, as carriers gravitated to smaller, more economical widebodies such as the Airbus A330 or Boeing 777; and adding more fuel-efficient engines to the A380, an upgrade Airbus has pulled off for smaller planes, remains risky with so few orders coming in.

Although the A380 is popular with passengers for its spacious interior and smooth flight, carriers find it tough to fill in turbulent economic times. Malaysia Airlines learned this the hard way when, in the wake of a pair of fatal crashes involving other aircraft, it couldn’t draw enough traffic to fill the half-dozen A380s it had bought. The airline is trying to offload two of them but can’t find buyers.

Lately, Airbus has seen a hemorrhaging of contracts that once seemed solid. In the past two years, three A380 customers have dropped their orders because of financial difficulties or shifts in strategy. Leasing company Amedeo three years ago announced plans to buy 20 A380s, but it’s failed to find a single airline willing to lease them and has delayed deliveries.

The plane’s biggest fan by far is Emirates, with 81 flying and an additional 61 reserved, which adds up to 45 percent of the A380s Airbus has delivered or has on order. The carrier is fretting about the jumbo’s future. “I think the size of the plane scares most of the airline world,” says Emirates President Tim Clark.

The A380 was a prestige-fueled project for Airbus and the European governments that backed the program. The company had been successful with its A320 single-aisle jet introduced in the 1980s, but it wanted a bigger piece of the lucrative long-range market. With the managers who hatched the plan two decades ago long gone, the ardor has abated, says Richard Aboulafia, a longtime critic of the plane and vice president of aviation consultant Teal Group. “Nobody seems to want this plane other than Emirates,” he says. “The A380 might just make it until 2020, but even that’s almost optimistic at this point.”

The bottom line: A decade after the Airbus A380’s debut, its future is in doubt as airlines shift to more efficient planes.

Source: Bloomberg