Wacha1

JF-Expert Member

- Dec 21, 2009

- 16,681

- 8,233

Market misery as shares crash further ...

Mid-afternoon slump ... traders on NY exchange

Mid-afternoon slump ... traders on NY exchange

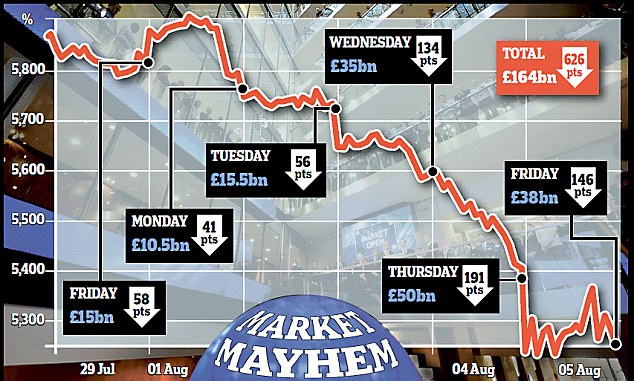

BRITAIN'S stock market has suffered its worst week since the banking crisis three years ago - after another bloodbath today.

Some £38 BILLION was wiped from Britain's biggest companies in the City today. The FTSE 100 plunged 146.15 to 5246.99 - a fall of almost 3 per cent. It took the plunge for the week to an astonishing £164 billion - second only in history to September 2008 when US bank LEHMAN BROTHERS collapsed. Markets around the world had briefly rallied in early afternoon when official employment figures in the US beat expectations. A net 117,000 jobs were created in the States in July.

But shares then nosedived again on growing panic about the mammoth debts facing Spain, Italy and the US. Manoj Ladwa of brokers ETX CAPITAL added: "The US job figures were a short-term blip. They were nothing in the grand scheme of things. "They weren't enough to alleviate concerns about what's going on in the US - and they were definitely not enough to alleviate concerns about what's happening in Europe." Despite the crisis the EU's economics commissioner Olli Rehn called for the markets not to panic claiming the shares plunge was "not justified". But experts believe it is inevitable America will now print billions more dollars in a third round of Quantitative Easing in yet another bid to kick-start their flagging economy.

PanicPanic gripped the City yesterday on Black Thursday as the European Commission chief warned that concern about debt mountains in eurozone countries is spiralling out of control. Jose Manuel Barroso said it went beyond basketcases Greece, Ireland and Portugal.

The FTSE 100 fell 3.4 per cent or 191.37 points to 5393.14 on Thursday - its worst slide since September 2009 - over worries of a new global recession.

France's CAC was down 3.9 per cent and Germany's DAX by 3.4 per cent. In New York the Dow Jones lost 512 points or 4.3 per cent, its worst one-day slide since February 2009. Today London's leading shares index sustained more heavy losses as the FTSE 100 Index opened more than 2.5 per cent lower - off 140 points at 5253 - amid investor panic.

The collapse came amid rising panic that Italy and Spain - the eurozone's third and fourth largest economies - may need bailouts.

Lenders have lost confidence in Spain's ability to handle its debts. That led to a hike in the country's cost of borrowing yesterday - which sparked the latest stock plunges. Mr Barroso fuelled the carnage in a letter to eurozone leaders. He said: "It is clear that we are no longer managing a crisis just in the euro-area periphery."

And he said the EU deal hammered out just two weeks ago to stabilise the euro had FAILED. Mr Barroso said the new Greek bailout and a beefing up of the EU Stability Fund were "not having their intended effects on the market". He is furious that most governments are now on HOLIDAY instead of fighting the crisis. Today Mr Rehn admitted the Greece rescue package and fears for Italy and Spain's economies which sparked the global panic had not been anticipated. This morning he said: "Markets have not reacted as we expected or hoped for to the measures agreed by the euro area heads of state and governments on the 21 of July.

"The spread of bond markets tensions across the euro area is however not justified by economic and budgetary fundamentals."

UK regulators have also asked banks to reveal their exposure to Belgium amid fears for its economy. Separately, the Centre for Economics and Business Research said Brits' living standards may fall by a QUARTER over the next generation. It blamed a wage squeeze as the UK competes with emerging economies and the fight for raw materials pushes up energy costs. But the Treasury said Britain will be safe because "of our difficult decisions to reduce the deficit and tackle our debts". Chancellor George Osborne is receiving regular briefings on the crisis while on hols in Los Angeles.

Asian markets also suffered similar losses today.

Japan's Nikkei 225 index lost 3.4 per cent, South Korea 4.2 per cent, and Australia tumbled 2.4 per cent.

- THE Bank of England held interest rates at 0.5 per cent yesterday.

...But bankers enjoy £80,000 party

High rollers ... bankers take a gamble

High rollers ... bankers take a gamble

BOOZED-up bankers sank champagne and oysters at an £80,000 party just hours after the FTSE plummeted.

The 4,000 revellers ignored the bad news as they supped free cocktails, gambled at roulette tables, danced wildly and sat in supercars at Wednesday's Square Mile magazine bash.

One said: "Nobody likes to admit they work in banking, but they're still reaping the rewards."

Wheeler dealers ... Porsche GT2RS on show

Good times ... they get carried away

Je, bado tuendelee kuwa watumwa wa hawa wathungu ambao wanaonekana hawana uwezo wa kudhibiti uchumi wao wenyewe. Wamekuwa wakiishi kwenye muda wa kuazima kwa miongo kadhaa.